Enhance Capital With Strategic Suggestions From Succentrix Business Advisors

Enhance Capital With Strategic Suggestions From Succentrix Business Advisors

Blog Article

Optimize Your Revenues With Expert Assistance From a Service Bookkeeping Consultant

By recognizing your special organization demands, they give insights into budgeting, tax obligation planning, and cash money flow monitoring, making sure that your financial sources are optimized for growth. The actual inquiry continues to be: how can you identify the right advisor to lead you through the complexities of monetary decision-making and unlock your business's full potential?

Recognizing the Function of Accountancy Advisors

Additionally, accounting advisors help in analyzing financial data, permitting entrepreneur to comprehend their monetary setting and prospective areas for development. They likewise play a significant role in budgeting and forecasting, making certain that companies allocate sources effectively and plan for future expenditures (Succentrix Business Advisors). By advising on tax methods and conformity, these specialists assist decrease liabilities and enhance economic results

Furthermore, accounting consultants may assist in determining cost-saving possibilities and boosting functional efficiency, which can bring about improved success. Their knowledge includes providing insights on financial investment choices and risk monitoring, assisting services towards sustainable development. Overall, the role of audit experts is important to cultivating a solid monetary structure, empowering companies to prosper in a competitive setting.

Advantages of Professional Financial Guidance

Professional financial support supplies many benefits that can substantially enhance a service's economic method. Involving with an economic advisor offers access to expert knowledge and understandings, enabling businesses to browse complicated financial landscapes better. This know-how aids in making educated choices relating to investments, budgeting, and expense management, consequently enhancing source allocation.

Furthermore, expert experts can determine potential threats and possibilities that may be forgotten by in-house groups. Their objective point of view help in developing robust monetary forecasts, allowing organizations to plan for future growth and reduce prospective obstacles. Additionally, financial advisors can assist enhance accountancy processes, making sure compliance with guidelines and reducing errors that can result in punitive damages.

Key Providers Used by Advisors

Among the essential solutions offered by financial experts, tactical monetary planning attracts attention as a crucial offering for businesses seeking to boost their fiscal wellness. This includes extensive analysis and projecting to line up monetary sources with long-lasting organization objectives, guaranteeing sustainability and development.

Additionally, tax obligation preparation is an essential solution that assists companies navigate complicated tax obligation policies and optimize their tax obligation liabilities. Advisors work to recognize potential deductions, credits, and methods that decrease tax problems while making certain conformity with legislations.

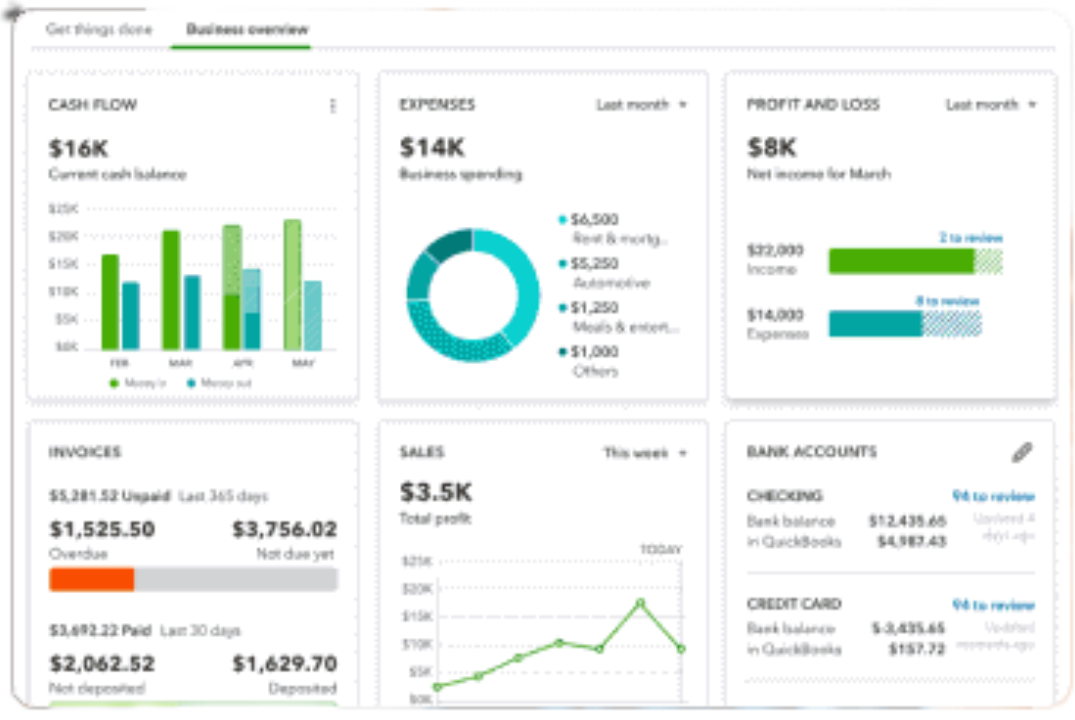

Capital management is one more vital solution, where experts aid in tracking and optimizing cash inflows and outflows. Effective cash money flow administration is critical for maintaining liquidity and supporting recurring operations.

Advisors also offer monetary coverage and evaluation, delivering insights with in-depth records that allow local business owner to make informed choices. These records often include key performance indications and trend analyses.

Lastly, risk management solutions are vital for identifying prospective financial dangers and creating methods to alleviate them. By dealing with these threats proactively, companies can secure their possessions and make sure long-lasting stability. Jointly, these solutions empower businesses to make enlightened economic choices and accomplish their objectives.

Selecting the Right Accountancy Consultant

Choosing the ideal accounting expert is a critical choice that can substantially affect a service's financial success. Examine the expert's credentials and credentials.

Additionally, examine their experience within your market. An advisor knowledgeable about your details market will understand its special obstacles and chances, allowing them to offer tailored recommendations. Look for someone that demonstrates a positive strategy and has a record helpful services accomplish their monetary objectives.

Communication is important in any type of consultatory connection. Select try this out a consultant who prioritizes clear and open discussion, as this cultivates an effective collaboration. In addition, take into consideration the variety of services they use; a well-shaped expert can give understandings beyond basic accountancy, such as tax obligation technique and financial forecasting.

Lastly, trust fund your reactions. A strong rapport and shared worths are crucial for a lasting partnership. By taking these factors right into account, you can select a bookkeeping advisor that will certainly not just fulfill your demands but additionally add to your organization's total growth and profitability.

Real-Life Success Stories

Successful businesses usually attribute their accountancy consultants as essential gamers in their financial accomplishments. Succentrix Business Advisors. By involving an accounting consultant, the firm implemented extensive monetary projecting and budgeting strategies.

In another case, a start-up in the technology sector was grappling with fast growth and the intricacies of tax obligation conformity. The business enlisted the expertise of a bookkeeping consultant who structured their financial processes and established a detailed tax obligation strategy. Because of this, the startup not only lessened tax obligation responsibilities yet additionally secured extra financing by offering a robust financial plan to financiers, which considerably increased their development trajectory.

These real-life success stories highlight just how the right accounting consultant can transform go to my blog monetary obstacles right into possibilities for development. By providing tailored understandings and approaches, these professionals encourage businesses to maximize their economic health and wellness, enabling them to attain their lasting objectives and make best use of earnings.

Conclusion

In final thought, the know-how of a service accountancy consultant confirms crucial for taking full advantage of profits and achieving lasting development. By supplying customized strategies in budgeting, tax planning, and cash flow monitoring, these specialists equip businesses to browse financial complexities properly.

Bookkeeping experts play a crucial duty in the economic health and wellness of a business, offering essential guidance on different economic issues.In addition, audit consultants help in interpreting monetary information, enabling company proprietors to understand their financial position visit the website and possible areas for growth.Expert economic support supplies numerous benefits that can significantly improve a business's financial approach. Involving with a monetary advisor gives access to specialist understanding and understandings, enabling businesses to browse complex economic landscapes extra successfully. They can straighten economic preparation with details organization goals, making sure that every monetary decision adds to the total tactical vision.

Report this page